Contents:

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 .

Argen X SE – ADR 52 week high is $407.93 as of April 29, 2023. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

ARGX Price/Volume Stats

Argenx developed and is commercializing the neonatal Fc receptor blocker in the U.S., Japan, and the EU. Its product pipeline includes product candidates such as ARGX-117, ARGX-118, ARGX-115, ARGX-116, and others. 18 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for argenx in the last year. There are currently 1 hold rating and 17 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should “buy” ARGX shares. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

argenx Third Quarter 2022 Earnings: Beats Expectations – Simply Wall St

argenx Third Quarter 2022 Earnings: Beats Expectations.

Posted: Fri, 28 Oct 2022 07:00:00 GMT [source]

According to 13 https://1investing.in/, the average rating for ARGX stock is “Strong Buy.” The 12-month stock price forecast is $452.85, which is an increase of 16.75% from the latest price. According to analysts’ consensus price target of $452.94, argenx has a forecasted upside of 16.8% from its current price of $387.88. Argenx has been the subject of 7 research reports in the past 90 days, demonstrating strong analyst interest in this stock.

Is It Time to Sell ARGX? Shares are up today.

Style is calculated by combining value and growth scores, which are first individually calculated. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Breakout trade in ARGXArgenx is another biotech stock setting up in a textbook breakout pattern. Shares traded up through resistance Monday morning on good volume, but the move was ultimately held back by a nasty overall market. ARGX still held up well, and will likely continue its advance higher. Argenx is another biotech stock setting up in a textbook breakout pattern.

argenx SE Has Near Gain Ahead Says Hedging By Market-Makers … – Seeking Alpha

argenx SE Has Near Gain Ahead Says Hedging By Market-Makers ….

Posted: Mon, 07 Mar 2022 08:00:00 GMT [source]

In terms of volatility of its share price, ARGX is more volatile than merely 0.5% of stocks we’re observing. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

US Futures, European Stocks Fall

chi sq capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Upgrade to MarketBeat All Access to add more stocks to your watchlist. One share of ARGX stock can currently be purchased for approximately $387.88. Biden’s disturbing new government program may be worse than Obama’s. A former bank regulator is blowing the whistle on Biden’s frightening plan to take over your money.

argenx SE (ARGX) Stock Price, Trades & News – GuruFocus.com

argenx SE (ARGX) Stock Price, Trades & News.

Posted: Sat, 20 Apr 2019 22:11:58 GMT [source]

This is a higher news sentiment than the 0.65 average news sentiment score of Medical companies. The company’s average rating score is 2.94, and is based on 17 buy ratings, 1 hold rating, and no sell ratings. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. We’d like to share more about how we work and what drives our day-to-day business. CompareARGX’s historical performanceagainst its industry peers and the overall market.

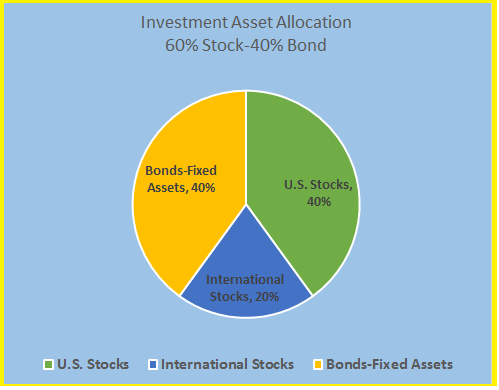

A Graphic Look at Selected Shares

We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Style is an investment factor that has a meaningful impact on investment risk and returns.

The profusion of opinions on social media and financial blogs makes it impossible to distinguish between real growth potential and pure hype. 52 week low is the lowest price of a stock in the past 52 weeks, or one year. Argen X SE – ADR 52 week low is $267.35 as of April 29, 2023. 52 week high is the highest price of a stock in the past 52 weeks, or one year.

Stocks with similar financial metrics, market capitalization, and price volatility to ARGENX SE are TGTX, GLYC, GERN, RETA, and LXRX. The technique has proven to be very useful for finding positive surprises. Let us take a look at some biotech stocks, ARGX, BMRN, LLY and GMAB, which are poised to beat on third-quarter earnings. Real-time analyst ratings, insider transactions, earnings data, and more. The P/E ratio of argenx is -29.54, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. If you want to revitalize your portfolio with some exciting opportunities, these biotech stocks to buy might fit the bill.

We have 9 different ratings for every stock to help you appreciate its future potential. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Below are the latest news stories about ARGENX SE that investors may wish to consider to help them evaluate ARGX as an investment opportunity. As for revenue growth, note that ARGX’s revenue has grown -75.11% over the past 12 months; that beats the revenue growth of only 2.32% of US companies in our set. ARGX scores best on the Sentiment dimension, with a Sentiment rank ahead of 96.96% of US stocks.

$ARGX with a Bearish outlook following its earnings #Stocks The PEAD projected a Bearish outlook for $ARGX after a Positive Under reaction following its earnings release placing the stock in drift D. The PEAD projected a Bearish outlook for $ARGX after a Positive Under reaction following its earnings release placing the stock in drift D. Other market data may be delayed by 15 minutes or more. VYVGART is the first neonatal Fc receptor blocker approved in the UK for the treatment of adults living with generalized myasthenia gravis who are anti-acetylcholine receptor anti… P/B Ratios above 3 indicate that a company could be overvalued with respect to its assets and liabilities. Earnings for argenx are expected to grow in the coming year, from ($8.77) to ($4.78) per share.

These are established companies that reliably pay dividends. The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days. Market cap, also known as market capitalization, is the total market value of a company. It’s calculated by multiplying the current market price by the total number of shares outstanding.

Short interest in argenx has recently increased by 1.65%, indicating that investor sentiment is decreasing.

High institutional ownership can be a signal of strong market trust in this company. In the past three months, argenx insiders have not sold or bought any company stock. MarketBeat has tracked 9 news articles for argenx this week, compared to 3 articles on an average week. Argenx has a short interest ratio (“days to cover”) of 4.2. 1.70% of the outstanding shares of argenx have been sold short. With a price/sales ratio of 2,014.54, ARGENX SE has a higher such ratio than 99.71% of stocks in our set.

Only 1 people have added argenx to their MarketBeat watchlist in the last 30 days. This is a decrease of -80% compared to the previous 30 days. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Intraday Data provided by FACTSET and subject to terms of use.

- CompareARGX’s historical performanceagainst its industry peers and the overall market.

- An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s.

- For example, a report published by the JAMA Network indi…

- You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

- Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

A webcast of the live call may be accessed on the Investors section of the argenx website at argenx.com/investors. A replay of the webcast will be available on the argenx website for approximately one year following the presentation. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Provide specific products and services to you, such as portfolio management or data aggregation. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Argenx is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season. The company is scheduled to release its next quarterly earnings announcement on Thursday, May 4th 2023.

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Historical and current end-of-day data provided by FACTSET. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements.