Contents:

You might also want to look into freelance and for-hire contractor sites, such as UpWork or Fiverr, where people list their rates. Find bookkeepers that are similar in your skill set and experience to help gauge what you should be charging. Many clients will look for your website to find out about you and your experience. If you’re specifically running a totally virtual business, a website is extra important since it can demonstrate to clients your skills. And luckily, there are plenty of website builders to make creating your website a breeze.

Others options that you might explore depending on the types of clients you serve and the services you provide include FreshBooks, Zoho, Sage Intacct, and Xero. Understand Your Tax Obligations – In addition to federal income tax (and self-employment taxes if the business is a pass-through entity), there may be other taxes at the state and local level. The taxes and fees a bookkeeping business must pay will depend on the business structure and where the company is located. Some of the possibilities include state and local income tax, gross receipts tax, franchise tax, and state and local sales tax. Choose a Business Structure –The business entity type you select for your business will have legal and tax implications.

Drake Forester is Northwest how to calculate sales tax’s Chief Legal Strategy Officer. His creative thinking and razor-sharp business mind have helped guide Northwest’s vision of empowering business owners for more than 15 years. Northwest Registered Agent is here to help with all your small business ideas and needs. Answer a few simple questions about your business, and we’ll prepare and submit your formation paperwork to the state. We also provide your new business registered agent service, free business forms and guides, and much more.

Step 1 – Choose Your Website Platform

Everything you learn will be beneficial for helping you make smarter business decisions. That last-minute stress of trying to find a crucial piece of business can lead to missed deadlines and some small errors creeping through. Businesses of any size can’t afford to make any mistakes and bookkeeping regularly can help with that. What other marketing techniques have you had success with while operating on a small budget? Don’t forget to also get your business listed on as many online business directories as possible. You’ll also need the signature of someone authorized to sign on behalf of the business, along with the state’s filing fee.

In your company analysis, you will detail the type of bookkeeping business you are operating. A small group coaching + mentoring program coupled with an online course that takes you through 3 simple phases to create the business of your dreams and serve your clients at your highest level. We recommend using LivePlan as the easiest way to create graphs for your own business plan.

The Investment Needed to Start a Bookkeeping Business

Facebook, Twitter and LinkedIn can all help you reach prospective clients. Set up a Facebook business page that clearly outlines the services you offer. Like a business bank account, a business credit card allows you to differentiate between personal and professional spending. It also builds business credit and gives you additional financing to help with the initial growth of your business. Again, you don’t have to come up with the perfect answer—it can change over time. However, find the UVP that feels right to you now and leverage it in all your marketing.

Vesey Ventures closes maiden FinTech-focused investment fund – fintech.global

Vesey Ventures closes maiden FinTech-focused investment fund.

Posted: Mon, 24 Apr 2023 09:50:10 GMT [source]

It explains your business goals and your strategy for reaching them. Accounting and bookkeeping services are purchased by owners and top managers of small businesses. They will contact businesses by phone and generally meet in person (at the client’s office) to interview and discuss the prospect of working together.

Examples of Retirement Business Ideas

If you can help a business stay on top of their books and ahead of problems, they’re not going to care about the schools you went to. Online accounting software will let you look at accounts at the same time as your client. This means you can talk through their questions over the phone, reducing the number of meetings you have. All content on this page is for general informational purposes only and does not apply to any specific case, is not legal, tax or insurance advice and should not be relied upon. Please note that the information provided on this page may change at any time as a result of legislative action, court decisions or rules adopted or amended by any state or the federal government. You may also look to become a limited liability company and potentially even office space at the time you hire on employees, so bear those regulations and costs in mind as well.

Rich and Jodi Erkens, Audio Video Extremes, named Small … – SC Times

Rich and Jodi Erkens, Audio Video Extremes, named Small ….

Posted: Sun, 23 Apr 2023 09:32:34 GMT [source]

According to the Small Business Administration , 99% of all businesses in New Mexico are small… To help you in that journey, we’ve created a checklist full of useful tips on bookkeeping and what to look out for when using an app. We all know that the government always comes out with a new initiative which is mainly to make things easier for them. Most recently, it’s the Making Tax Digital initiative with which the government is expecting businesses to comply.

Steps to Starting a Bookkeeping Business

The AIPB and the NACPB are the top two associations for bookkeepers. Professional associations often promote or host seminars and training. Sometimes, members can get discounted rates on these events as membership perks. Being part of these associations can also help you build your network with other bookkeepers, CPAs, and tax experts. Investing the time to attend a conference will give you those continuing education credits you need to keep your bookkeeper or CPA certification. It’ll also enable you to learn what the hottest trends in the industry are and what’s becoming obsolete.

After potential clients contact you, you’ll schedule a meeting for your initial consultation, aka discovery call. This is arguably the most critical step in the entire process to acquire and find new clients. If you’re just starting your own cpa firm, you may not have any, but add some later when you do get them. Whether you create your website yourself or hire a web developer, you’ll likely need to determine what you want on your website and factor that into your startup costs.

How a Bookkeeper Is Different Than an Accountant

In order to be a quality bookkeeper, you need to learn the tricks of the trade. There are a few tools that will come in handy as you begin this journey. The business license usually needs to be renewed every year so you can keep up practice in your given location. Know exactly where your ecommerce business stands financially. We’ll propose 3 different ways to work together at 3 different price points.

Is bookkeeping a good side business?

Overall, bookkeeping is an incredibly flexible online side hustle. If you're interested in making an extra $500 to $1,000+ a month, bookkeeping is a solid fit, but it's also incredibly scalable if you want to grow it into a full-time business.

That way, your customers could choose a plan based on their business size, bookkeeping budget, and needs. Typically, both the customers and the bookkeeper prefer a fixed rate. Since you both know exactly how much you’ll be making each month which makes it easier to manage your budgets and cash flows. Your clients will love it because there will be no surprises and they will know exactly how much you will be charging them each month. A nice one-two punch to help automate accounting and bookkeeping services is to use cloud software coupled with an expense management app. Practice management software is arguably the most important piece of bookkeeping software in your own accounting practice.

Your site doesn’t have to be complicated—a single page with your name, what services you offer, contact information, and some testimonials is plenty. Consider the costs of having a site created (if you don’t have the skills to do it yourself), web hosting, and domain registration. Check out our guides to the best free website builders and cheap web hosting for a great place to start.

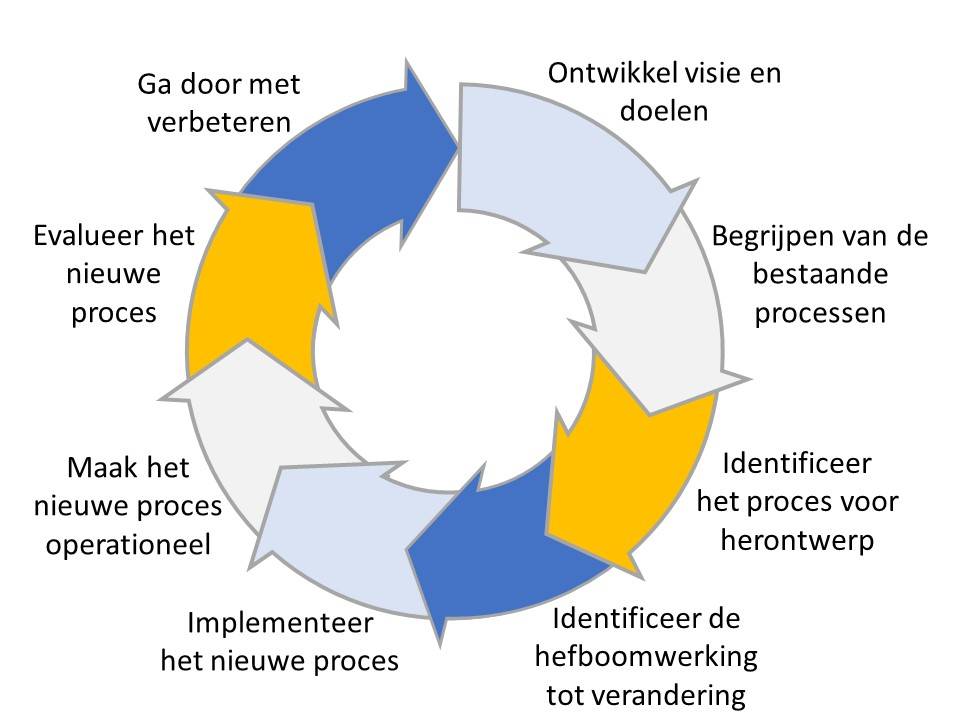

Annual profits of bookkeeping businesses vary, however, you can make anywhere from $10,000 to several million dollars a year. It will all depend on how you manage and scale your business. To run a successful business, make sure your business stands the test of time so you can consistently get bookkeeping clients, you’ll need to engage in continuous improvement. By standardizing core processes, you’ll be able to better streamline your operations and ensure quality control when delivering client accounting services . It’s easier to standardize your own accounting business if you build processes around one of them. The more you can standardize, the more streamlined your business model will be when you get clients.

- You will want to make sure you register with the accountant version.

- They ensure there’s a clear path forward for any major issue that may arise, from changes in ownership to closing the business.

- It’s important that you are thinking of your own business as a complete solution to your client.

- It explains your business goals and your strategy for reaching them.

- Check out LLC vs Corporation and Why Turn a Sole Proprietorship into an LLC to learn more about choosing the best structure for your business.

Lastly, part of this process is picking a business name, which you should do with care. You’ll be using the name for years, so be sure it’s a professional and accurate description of your work. Ask clients to leave testimonials for you on social media and include put testimonials on your website.

What is a bookkeeping business?

Common Bookkeeping Responsibilities

Document and categorize transactions, including income and expenses. Manage a company's finances via business accounting software, such as QuickBooks or Xero. Assess a company's cash flow. Prepare financial statements, such as balance sheets and profit and loss statements.

For professionals and aspiring bookkeepers alike, certifications are a powerful way to boost your skills and add additional authority to your brand. You can gain certifications in bookkeeping itself as well as in the accounting software you plan to use to serve your clients. Just make sure you have a plan to pay off the balance before the introductory offer ends and a variable APR sets in. Accounting software providers on the market and is used by many small and large businesses alike.

Certification is also available within certain software products, too — for instance, you can get certified in QuickBooks. Help businesses with an overview of their finances to help them understand their habits. Naming your business can be both a fun and stressful exercise. Your name must convey your brand since that is what a potential customer will see before they sit down with you for that initial consultation.

Don’t wait until the last minute to add a new team member. If you suspect you’re getting close to expanding, start looking! Give yourself time to find the right person and get them up to speed.

Is bookkeeping a profitable business?

Starting your own bookkeeping business can be pretty profitable. There aren't significant barriers to entry if you already have experience. Aside from technical skills, you just need a computer, internet connection, and place to work.