Content

- Changes in CBO’s Baseline Projections of the Deficit Since May 2022

- Revenues, by Category

- Examples of Accumulated Deficit in a sentence

- Key Inputs in CBO’s Projections of Real Potential GDP

- Other Measures of Debt

- Uncertainty About the Economic Outlook

- Key Changes in CBO’s Economic Forecast Since May 2022

Thus, any budgetary surplus is added to the Capital Fund while the budget deficit is deducted. The long-term spending projections were prepared by the Labor, Income Security, and Long-Term Analysis Division, with contributions from analysts in other divisions. The projections were prepared by Xinzhe Cheng, Damir Cosic, Kyoung Mook Lim, Michael McGrane, Charles Pineles-Mark, and Jordan Trinh.

- Net outlays for interest, which rose by 35 percent last year, are projected to increase by 35 percent again this year, from $475 billion in 2022 to $640 billion.

- An excise tax on the repurchase of corporate stock, which was enacted as part of the 2022 reconciliation act, will be collected starting in 2023, causing excise taxes to rise slightly in relation to GDP in 2024.

- Thus, it is a positive or debit balance of the income and expenditure account.

- A growth-focused company may not pay dividends at all or pay very small amounts because it may prefer to use retained earnings to finance expansion activities.

- October 1 will fall on a weekend again in 2028 and 2033, causing certain payments due on those days to be made at the end of September and thus to be recorded in the previous fiscal year.

To learn what each of these concepts is and how they are taxed, read our articles on The ABC’s of Distributions and Withholding Taxes. Though the last option of debt repayment also leads to the money going out of the business, it still has an impact on the business’s accounts . Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Changes in CBO’s Baseline Projections of the Deficit Since May 2022

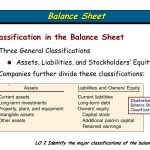

You’ll find retained earnings listed as a line item on a company’s balance sheet under the shareholders’ equity section. It’s sometimes called accumulated earnings, accumulated deficit calculation earnings surplus, or unappropriated profit. On a companies balance sheet you will find their economic resources, their future obligations, and their equity.

- The national debt does not include debts carried by state and local governments, such as debt used to pay state-funded programs; nor does it include debts carried by individuals, such as personal credit card debt or mortgages.

- The price of shelter services, which is affected indirectly by house prices, is also a source of uncertainty.

- In other words, the tax expenditure for all exclusions considered together would be greater than the sum of the separate tax expenditures for each exclusion.

- However, there are times when the organization doesn’t have enough revenue to meet its liabilities, resulting in a budgetary deficit.

- The Congressional Budget Act of 1974 requires that the federal budget list tax expenditures.

- The core PCE price index, which excludes food and energy prices, rose by 4.7 percent in both 2021 and 2022.

The labor force consists of people age 16 or older in the civilian noninstitutionalized population who have jobs or who are available for work and are either seeking work or expecting to be recalled from a temporary layoff. The labor force participation rate is the labor force expressed as a percentage of the civilian noninstitutionalized population age 16 or older. CBO’s projections of PCE inflation in 2025 and 2026 are slightly higher than they were in the agency’s May projections. CBO’s projections of CPI-U inflation in 2025 and 2026 are slightly lower than they were in the agency’s May projections. PCE inflation and CPI-U inflation were revised in opposing directions because the CPI-U places greater weight on prices of shelter services.

Revenues, by Category

Over the 2028–2033 period, CBO expects inflation to have reached the long-run average rate that the agency projects. CBO expects interest rates on Treasury securities to be lower, on average, than they were over the first five years of the projection period. Growth of real GDP averages 1.8 percent per year over the 2028–2033 period, the same as growth of real potential GDP. The average real output per unit of combined labor and capital services, excluding the effects of business cycles. Values for 2000 to reflect data on interest rates for the full month of December 2022. Those data were not available when CBO developed its current projections for 2022 to 2033 .

A stockholders’ deficit does not mean that stockholders owe money to the corporation as they own only its net assets and are not accountable for its liabilities, though it is one of the definitions of insolvency. It means that the value of the assets of the company must rise above its liabilities before the stockholders hold positive equity value in the company. Generally speaking, a company with a negative retained earnings balance would signal weakness because it indicates that the company has experienced losses in one or more previous years. However, it is more difficult to interpret a company with high retained earnings.

Examples of Accumulated Deficit in a sentence

In CBO’s projections, the labor force participation rate remains roughly unchanged at 62.2 percent in 2023. The labor force participation rate declines after 2023 as the effects of the aging of the population become more prominent in relation to the short-term effects of the expanding economy. CBO expects the labor force participation rate to decline from 62.2 percent in 2023 to 61.8 percent in 2027. Labor market conditions are expected to deteriorate as the slowdown in growth in early 2023 reduces the demand for workers.

- To calculate the accumulated deficit, you would start with the beginning retained earnings balance, add the net income for the period, and then subtract any dividends paid to shareholders during that period.

- It had roughly 1.5 million fewer people than the agency’s estimate of the potential labor force.

- Energy and food prices increased rapidly in the first half of 2022, boosted by the effects of Russia’s invasion of Ukraine.

- However, under guidelines agreed to by the legislative and executive branches, that change in revenues was not included in the totals used for budget enforcement purposes.

- In CBO’s projections, deficits equal or exceed 5.5 percent of GDP in every year from 2024 to 2033.

Annual wage growth is measured from the fourth quarter of one calendar year to the fourth quarter of the next. For the unemployment rate and labor force participation rate, data are annual averages. CBO currently projects higher inflation in 2023 and 2024 than it did last May. As a result, projections of nominal GDP and national income have increased through most of the forecast period, even though real GDP is lower than the agency projected last May. In CBO’s baseline projections, other mandatory spending measured as a share of GDP continues to decline after 2024 but at a slower pace, falling to 2.6 percent at the end of the projection period. The projected decline occurs in part because benefit amounts for many of those programs are adjusted for inflation each year, and in CBO’s economic forecast, the growth of nominal GDP outpaces inflation.

Offsetting receipts are funds collected by federal agencies from other government accounts or from the public in businesslike or market-oriented transactions that are recorded as negative budget authority and outlays . Technical changes increased CBO’s projections of net interest outlays over the 2023–2032 period by $188 billion . Most of that increase stems from a reduction in balances of nonbudgetary financing accounts that record the collections and disbursements of federal loan and loan guarantee programs. Other technical changes increased CBO’s estimate of outlays for other mandatory programs in 2023 by $32 billion and its projections of outlays for such programs over the 2023–2032 period by $118 billion.

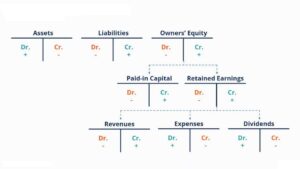

Due to the nature of double-entry accrual accounting, retained earnings do not represent surplus cash available to a company. Rather, they represent how the company has managed its profits (i.e. whether it has distributed them as dividends or reinvested them in the business). When reinvested, those retained earnings are reflected as increases to assets or reductions to liabilities on the balance sheet. Retained earnings are reported in the shareholders’ equity section of the corporation’s balance sheet.

Other Measures of Debt

Prices of those services make up 30 percent of the core CPI-U but only 17 percent of the core PCE price index. CBO’s forecast of the economy, especially its projections of nominal GDP, is a primary input in the agency’s baseline budget projections. As a result, much of the uncertainty of the baseline budget projections reflects the uncertainty of the economic forecast. CBO’s forecast for roughly zero growth of real GDP in 2023 is highly uncertain.

What is the accumulated deficit in IFRS?

The accumulated deficit is a note to the original retained earnings account. For any more asset and operation losses, companies continue to report them in retained earnings to increase the accumulated deficit, while maintaining the balances of other capital accounts as initially recorded.

What is included in accumulated deficit?

What is an Accumulated Deficit? An accumulated deficit is a negative retained earnings balance. This deficit arises when the cumulative amount of losses experienced and dividends paid by a business exceeds the cumulative amount of its profits.